1031 Exchange

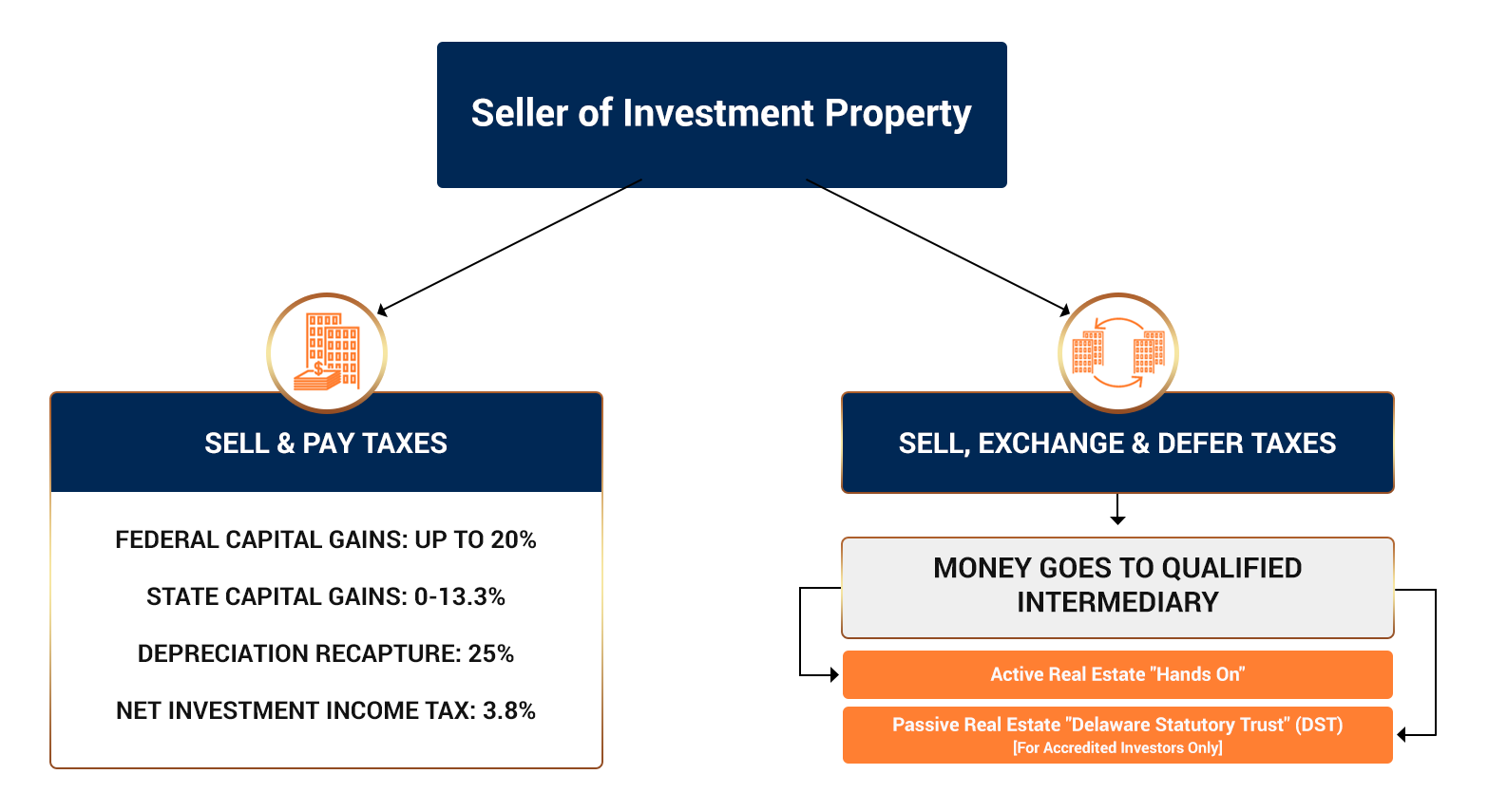

A 1031 exchange is a way to defer capital gains taxes by rolling the equity from the sale of one investment property into the purchase of another. Many clients seeking to increase their returns or reduce their management responsibilities opt for a 1031 exchange to achieve their investing goals.

Know the Basics

Instead of immediately paying capital gains on the sale of a property (the “down leg”), many investors prefer to defer that payment by purchasing a new property (the “up leg”) with the proceeds. This is referred to as a 1031 exchange, in reference to the section of U.S. tax code that defines it. There are specific rules and timelines related to a 1031 exchange, and it is important to have an experienced and knowledgeable specialist handling the process.

Lay the Groundwork

Speak with your real estate, financial and tax advisors to understand the timelines and restrictions and enlist a qualified intermediary to facilitate the transaction.

Sell a Property

The specialists at Susan Repp Real Estate have access to the largest pool of qualified buyers in the industry, helping you sell your property quickly and at a good price.

Identify Replacement

You have a limited time to make your next transaction, purchasing up to three replacement properties. Marcus & Millichap has the largest inventory of exclusive listings, giving you a range of excellent up leg options.

Purchase

As the market leader in 1031 exchanges and in overall transactions, Marcus & Millichap has the experience and expertise to guide you through the closing process successfully and painlessly.

Report Exchange

Your tax advisor must report the exchange on your tax return for the year in which you sold your down leg property.

The materials and resources provided on this website have been secured from sources Susan Repp Real Estate believes to be reliable, but Susan Repp makes no representations or warranties, expressed or implied, as to the accuracy of the information. This website is intended to be used for informational and illustrative purposes only and is not intended to provide, and should not be relied upon for, investment, accounting, legal, or tax advice. Susan Repp Real Estate cannot and will not provide any such advice relating to a 1031 exchange. Please consult with an expert when doing a 1031 exchange. You should not rely upon any of the materials and resources provided on this website for individual investment analysis and decisions. Always seek advice from the appropriate professionals before making any investment decision.

Is an Exchange Right for You?

While a 1031 exchange is the right decision for many investors, there are many rules and deadlines associated with it, and it’s important to work with experienced specialists. Our highly trained advisors bring years of expertise to every transaction, helping you execute your 1031 exchange flawlessly.

A 1031 Exchange is not an “all or nothing” proposition. A seller of property may choose to pay taxes, find their own real estate and/or use a DST in a combination they choose.

If you’re interested in increasing your returns, decreasing your management responsibility, or diversifying your holdings, a 1031 exchange may be the right choice for you. Contact us for opportunities to execute a straight exchange, diversify investment or add leverage.